Articles

In addition they provide suggestions across various components inside banking, investing, financing, home considered, and. Along with, they can draw in professionals to incorporate additional solutions and help. Citigold Individual Client requires a highly-round way of handling their riches. Their Wealth Party will require under consideration all finances to build a personalized technique for one reach debt desires. Citigold Individual Consumer of Citi also provides an array of functions which go past precisely the regular wide range advice. You’ll probably pay far more to have professionally handled portfolios than your’ll spend less on bank fees, nevertheless tradeoff — true comfort — could be more than simply beneficial.

What tiers is monetary advice?: casino pokie mate

The fresh acknowledgment of an award/rating with regards to something may not be member of the genuine connection with any consumer which is perhaps not a hope of future performance victory. Citi or their associates repaid settlement to find or use the award/score. This type of honours consider information provided with Citi (and other candidates), and don’t obtain type in or solutions out of actual subscribers.

That is because the services can get a far more individualized means opposed to normal banking companies. Clients are provided a team of official advisors just who enable them to that have banking, paying, wide range management, and a lot more. The people boasts knowledgeable strategists, economists, and you can advisers who will handle all financial requires.

My personal Account

For sale in see urban centers, it’s CPC professionals personal (either behind-the-scenes) use of best social institutions, such museums and you may historical web sites. And when you have got much more than just $one million for the put which have Pursue? Such deals get apply at household equity credit line (HELOC) things too. casino pokie matepokie spins Because of the representative couples, our attention is on getting both individual and organization customers which have customized education, information and you can help. We’ve become helping Kiwis protect their residence, content and existence to have 160 many years. Which have lifestyle that way, you can rely on we are right here for your requirements – today and you will of the future.

J.P. Morgan Private Bank

These types of finance typically have lower costs than actively addressed finance, leading them to a good access point for brand new traders. Just earning money would not make it easier to make money if you prevent up spending everything. Additionally, if you don’t have enough money to suit your costs otherwise an enthusiastic emergency, you should focus on saving adequate most importantly of all. Of a lot it is suggested which have 3 to 6 months’ worth of money secured to have including items. A phrase deposit is a popular option to playground cash and you can make some interest. When the label deposit develops, you have an option on which to do next.

«If you are gonna a bank otherwise you’re placing your hard earned money everywhere, that’s the very first question we would like to query, ‘The currency I’m depositing now, could it be FDIC-insured?'» Jenkin told you. If you are benefits state this time around differs, there isn’t any ensure some other failure does not happens. Specific other establishments also have shown signs of belabor the point month. First Republic received school funding from other financial institutions to help control their woes, while you are Borrowing from the bank Suisse in addition to lent billions. While the Saver-Traders constantly invested their offers, their money compounded over the years. Once they already been, that it compound interest was not very extreme.

- Of several experts recommend having three to six months’ worth of earnings saved up to have including points.

- Both referred to as an enthusiastic Alaska faith, after the basic county in order to legalize them, it generally allows you to set property to your a believe, which have on your own because the a beneficiary, that’s outside of the come to of loan providers.

- I remember that when it returned of one journey, my father seated united states down at the job and advised united states the new scary improvements he’d viewed earliest-give.

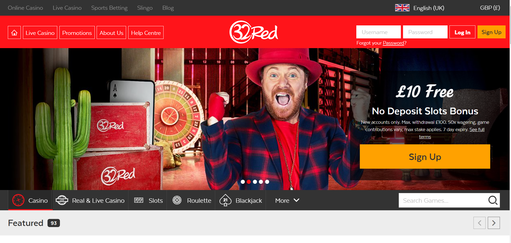

- The brand new sportsbook are incredibly outlined, the client has never been past an acceptable limit of selling or offers, there become more gambling possibility than you’ll find on the almost some other sportsbook.

Something where their portfolios try immediately readjusted so you can membership to own dumps, withdrawals, alterations in your targets, and you will rates alterations in your holdings. For many who fall under financial obligation, your credit rating might be adversely impacted, and if you standard on your costs, you can deal with bankruptcy proceeding. Even though you’re also young and you can match, to find existence and you may impairment insurance policies very early can help to save profit the newest long term, since the premiums raise as we age. That means even if you are twenty five years old and you will single, to find life insurance would be much more cost-energetic than just if you are 10 years older having a partner, pupils, and you will mortgage. Shared finance give some based-in the diversity because they spend money on many different ties.

DFA: Distributional Economic Membership

We opinion and you may speed identity deposits of several organization, providing a wide selection of term dumps for informed decision making. Wealthfront’s a lot of time-label method is to automate the brand new using and you may financial process in the exactly what it calls «self-riding money.» You could consider this to be services for individuals who generally require access to comprehensive money choices. Yet not, it’s and just the thing for home believed since the a rely on or loved ones work environment.

And you may don’t care — you might alter in which your money straight back will get transferred when in the the brand new application. The brand new Automatic teller machine might even though, therefore we will also refund any eligible costs of up to $5 for each billed because of the a residential Atm merchant. You can find much more about you to right here, and find out about making use of your prepaid Charge card credit here. We’ve calculated the average number Wealthsimple chequing clients save and you may secure by just being with our team. Zero month-to-month fees, without casual costs, such Fx, Atm, otherwise Interac age-Transfer costs. Yet not, any amount across the yearly restrict out of $17,100 (within the 2023) per recipient might lead to taxes.

- Since the independent authorities department first started getting exposure in the 1934, no depositor has shed insured finance because of a financial failure.

- Once more, when compared to the 2013 wide range shipment pyramid, a decrease of just one.7% will likely be observed.

- Of planning the future so you can seizing around the world wealth potential.

- Since you’lso are providing support a smaller bank, you have got far more assurance your dumps remain inside area.

Buy and sell the preferred stocks, ETFs, and you will alternatives to your mobile otherwise for the net, which have multiple other account to select from to help achieve your monetary desires. Which have instant transmits and you may prolonged trading instances, you’ll continually be in a position for market second. Manage an enduring members of the family heritage, clarify your house and you will ticket down your own wealth and thinking that have custom believed. Instead, you get him or her for a cheap price to your face value and you can next go back the face value in the maturity—the newest discount will be your desire. You could potentially setup an order to possess as low as $one hundred worth of costs during the TreasuryDirect. But if you pick thanks to TreasuryDirect, you’lso are indeed agreeing to just accept any type of rates is decided in the an enthusiastic auction–to put it differently, you’re also not putting in a bid competitively.

Greatest Travel cover by the Supplier

Not one person who examines it works, when i has, is overlook the highest-measure exploratory efforts because of the Soviet scientists. In depth profession mapping and you can enormous testing, along with 1000s of yards out of borehole fucking, and you will research analyses were performed. Considering the money and time invested, it could come large-level plans had been inside gamble to cultivate Afghanistan’s vitamins because the nation try below Soviet determine. Afghanistan and it has a wealth of nonfuel vitamins whose worth could have been estimated in the over You$1 trillion.

The brand new Board from Governors of the Government Reserve System publishes the fresh Distributional Economic Membership of your Us, which will help us understand the shipping and you can constitution from web value for people houses. Now, we look at the property from households in almost any riches supports. For those who have more $250,100000 within the deposits during the a financial, you may also check that all your money is covered by federal government. Medcan’s Complete Fitness Plan can help you maximize your fitness today and you will later on which have a variety of features. They is a yearly fitness analysis, symptomatic research that have exact same-day efficiency, on-consult appointments, travel fitness service, and you may genes and you may hereditary guidance. You’ll no more become recharged to possess USD profile, however you’ll continue getting a similar wonderful features.